CALL OR TEXT

BLOG

The Basics Of A Wraparound Mortgage

The Basics Of A Wraparound Mortgage

RPL Investors, LLC

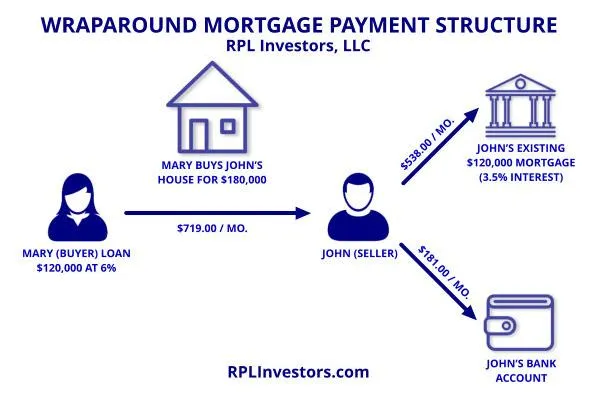

A wraparound mortgage, also known as an all-inclusive mortgage, is a financing arrangement that allows a borrower to use an existing mortgage to finance a new property. In a wraparound mortgage, the seller of the property finances the buyer's purchase by taking out a new mortgage that includes the balance of the existing mortgage. The buyer then makes monthly payments to the seller, who in turn uses those payments to make payments on the original mortgage. Essentially, the wraparound mortgage "wraps around" the existing mortgage, and the seller becomes the lender for the buyer's new mortgage.

One of the main advantages of a wraparound mortgage is that it can make it easier for buyers to secure financing, particularly if they have difficulty obtaining traditional financing due to a low credit score or other factors. Additionally, since the seller is financing the purchase, the buyer may not need to make a down payment, which can be particularly beneficial for first-time homebuyers. For sellers, a wraparound mortgage can be a way to sell their property more quickly. Since the seller is offering financing, the buyer may be more willing to purchase the property, particularly if they are having difficulty obtaining traditional financing. Another potential advantage of a wraparound mortgage for sellers is that they can often charge higher interest rates than they would receive from a traditional mortgage, which can allow the seller to generate additional income from the sale.

However, there are also some potential drawbacks to wraparound mortgages. One of the main risks is that it can be financially burdensome for the seller if the buyer defaults on the loan. If the buyer stops making payments on the wraparound mortgage, the seller may need to initiate foreclosure proceedings to recover the property. Additionally, if the original mortgage has a due-on-sale clause, the lender may have the right to accelerate the loan if the property is sold to a new owner. This can make the wraparound mortgage legally complex, and both buyers and sellers should review the terms of the agreement carefully.

To avoid potential legal issues, it is important for both buyers and sellers to review the terms of the wraparound mortgage agreement carefully. It may be helpful to consult with a real estate attorney or other professional to ensure that the agreement is legally sound. It is also important for both parties to agree on a payment schedule that works for both parties. This should include the interest rate, the length of the loan, and the frequency of payments. Additionally, both buyers and sellers should conduct due diligence to ensure that the property is in good condition and that there are no liens or other encumbrances on the property.

In conclusion, a wraparound mortgage can be a useful financing option for both buyers and sellers in certain situations. However, it is important to carefully consider the risks and benefits before entering into such an arrangement, and to seek professional advice as needed. With careful planning and legal guidance, a wraparound mortgage can be an effective way to finance the purchase of a property.